Driven by ongoing market pressures brought on by the COVID-19 pandemic, we have seen a surge of interest in special purpose acquisition (SPAC) transactions from companies across sectors. During this session, we heard from industry lawyers, exchange executives, and investment bankers on key considerations for navigating a SPAC merger, as well as their view as to whether SPACs will continue to serve as an ongoing liquidity option or if this surge of interest is simply a passing trend.

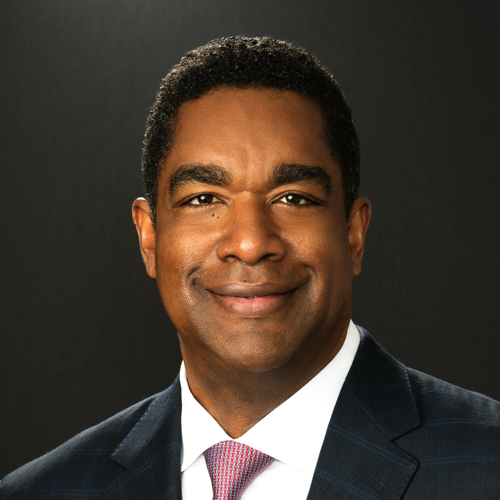

Cooley Partner Yvan-Claude Pierre joined a panel of other market leaders and discussed the following topics:

- The benefits of SPACs as a path to liquidity

- Companies choosing SPACs over regular-way IPOs

- The role of private investments in public equity (PIPEs) in future SPAC transactions

- Outlook for new fundraising

- The role communications plays in the SPAC process

This event occurred on Tuesday, November 24th at 4:00 pm to 5:15 pm EST

No recording available